Insurtech, Dealing With The Burger Dilemma!

At Daphni we have been reviewing insurtech for a while, but we have not done our first investment yet. That’s why we tried to understand exactly what we were looking for. Here is a short summary of what we have understood so far.

Today there are not so many industries that look as appealing as insurtech for an investor: a tremendous market with old incumbents operating based on complex and outdated IT systems and poor customer satisfaction. In addition, the financial model is very predictable thanks to a high customer loyalty. This mix of factors could explain why the valuation of insurtechs are going crazy even for a very limited number of users.

After such a description, the market looks really similar to what we have seen with the emergence neobanks a few years ago: fully digital actors that innovate from user experience to infrastructure. Surprisingly, insurtech in Europe has not seen yet any success story comparable to Revolut or N26 in banking. It seems that doing a raw comparison between the situations would be bit simplistic, still we decided to have a look at the insurtech landscape.

In this article, we decided to focus on the consumer part of the insurtech landscape. However, we will cover insurance company services in future articles.

A Stack Complex By Nature

The insurance stack is complex by nature with multiple layers. The simplest approach would be to describe it with 3 layers: brokers, insurers and reinsurers. However, the reality is trickier, and there are often more intermediaries. For instance, an insurtech which designs its own products but which operates under the status of broker will often work with other brokers (on the image insurance advisors) to distribute its products.

One of the key layers of the stack is the relationship with the customer and this relation is mainly managed by the brokers. However, the concept of broker is really large as they can just assemble existing offers for their clients, but they can also build specific offers from scratch and working with insurance companies.

For the latter, their strategy is often to be the contact point for the customer and gradually “climb-up” the value chain. The main reason to remain license free for these players at first is the capital needed to obtain the license. Regulatory bodies are really unfavorable for insurtech, as there are specific rules based on the growth and the capital requirement for them is huge. The long term strategy for these start-ups is often to become an insurer for only a part of their products.

A Second Wave of Insurtech

Banking has seen a first wave of innovation with digital banks in the 2000s before the current inception and growth of Neobanks. Let’s have a look on the insurtech side. The first wave of insurtechs emerged at the end of the 90s. Most of them took part of the internet to offer a better comparison of the offers (Assurland) or to propose cheaper services (Direct assurance). On that perspective, the insurance market is quite comparable to the banking market a few years ago when the rise of mobile offered new opportunities. Although there are few insurance apps, there is no revolution yet in the customer relationship or in the usage. The second revolution of insurance seems still to launch.

So Is Neoinsurance The New Neobank ?

As the market looks really similar regarding the size and the structure of the incumbents, the temptation is high to extend the comparison. There’s definitely room for an upcoming insurtech player to pace up with the neobanks and also innovate on this market, with companies offering a great experience with cheap prices and a seamless UX/UI.

Still, there are structural differences between these markets:

- The number of contact points you have with your insurer is really limited. For most customers, the only point of contact with the insurer is the signature of the contract and the claim process. In this context, the insurer needs to make dramatical improvements in the user experience, as the natural churn from customer dissatisfaction is low. UX is probably not a strong enough differentiator in this context.

- The price is also the main difference. When you can onboard on more than ten neobanks with a freemium account, you always need to pay for an insurance, which slows your growth as you must prove first that you offer the customer a life-changing value.

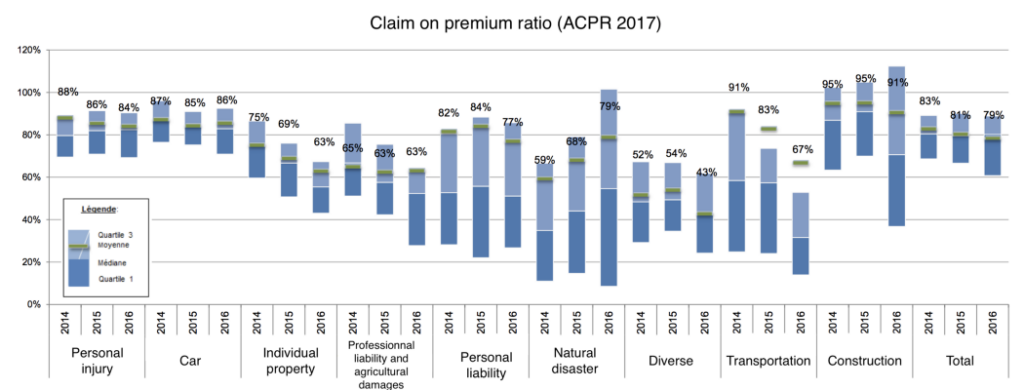

- The third main difference is in the cost structure. As shown by the following chart, the cost structure of insurance is closely linked to the claims. These costs are substantially more difficult to compress. For instance, claims represent about 86% of the expenses in the insurance car industry (in 2016). On health insurance, some people try to reduce these claims by working on prevention and by incentivising people to practice sport or to make healthy habits. Even if insurers are often mocked for their lack of productivity, the cost associated with the administration is not that high, only at 11% of the total cost. Eventually, it is hard to believe that you can decrease the price sharply without decreasing the cost. The only way to decrease price will be to select the best customers with the smaller risk or to customise the price regarding the needs.

However, there are several similarities shared by both markets:

- A common aspect of the banking industry is the desire of the incumbent to partner with startups. The vast majority of insurers we have been in touch with are convinced that innovation will come from startups and they want to take part in this innovation. This is a double-edged sword for startups.

- There is also a similarity in finding the right timing to become self-sufficient. As an early stage company, the support of a very large organisation can be really helpful but it’s important to ask oneself if disruption really can take place if partnering with people who have no direct interest in changing the game? The example of Neobanks shows that if you want to bring profound innovation you need to license yourself in the long run. N26 is already a bank while Revolut is reportedly seeking a US license.

- Another common element is the importance of trust. Just as traditional banks, major insurers are both hated and trusted. For things that really matter to you such as your money or your house, you feel more comfortable to work with an institution which has existed for decades. Paradoxical it may seem, people are not happy with the service provided by the incumbents but feel safer to be their clients.

A New Kind Of Innovation?

I’ve met many people complaining about the lack of innovation in the area. Nevertheless, don’t despair, innovation is currently impacting many subfields in the industry:

- Cyber Security: This is a super-hot insurtech topic. The current protection services are often built around an initial audit (instead of continuous monitoring) and assessed by questionable criteria, such as the presence of a firewall. This process looks totally outdated in a world where micro-services are the norm and where tech teams can ship releases several times a week. Another aspect to tackle this topic is employee sensitisation. Human error remains the easiest entry point. The current challenge is to find the right model to evaluate risk with few available data.

Examples of startups in the area: Sqreen, Checkmarx, Waratek, Immun.io, Deemly, Zeguro, CyberDirekt, Quarkslab. - Parametric Insurance: In real life, smart contracts are not easy to use for mainstream insurance contracts. However, they offer a great opportunity to lower costs and increase processing speed. For instance, they could work very well for flight insurance. Smart contracts could be linked to an air traffic control database, and automatically trigger compensation when delays or cancellations occur.

Examples of start-ups in the area: Blink, Moonshot, Etherisk. - Niches insurances: Insurances tailored for goods (such as drones or mobile phones) or pets are not mainstream among the incumbents and offer good opportunities to grow with very small costs of acquisition for insurtech startups.

Examples of start-ups in the area: Valoo, Otherwise, Lovys, Gavin, Monuma, so-sure. - Car insurance: Car insurance has offered different kinds of innovations with pay-per-km insurance, behavioural or even pay-per-use solution.

Examples of startups in the area: Leocare, Wilov, Friday, Nexible, Amaguiz, Carapass, InMiles, Cuvva, Keysurance. - PropTech: The main part of innovation within this field regards the adoption of payments related to the number of days spent in an apartment/home/house. The use of IoT is also growing.

Examples of start-ups in the area: Luko, Leocare, Tipi. - Healthtech: Different companies offer health insurance with a focus on customer service and UX. The prevention or incentivisation to have a healthy way of life are also promising opportunities.

Examples of start-ups in the area: Alan, Ottonova, GetSafe, Dandelin. - SMEs and Freelance: In this segment, distribution is key.

Examples of start-ups in the area: +Simple, Wemind, Phileass, Optisure, Assurup, Digital risks.

Where Is The Innovation Happening Today?

As in Fintech, international markets are very different, being a copycat of a successful company is not guaranteeing success. As of today, players such as Lemonade in the US or Zhong An in China have no European equivalent.

- Germany is clearly the leader in European Insurtech. The number of startups asking for an insurance license is the higher in Europe with 8 different projects according to BlackFin (Friday, Ottonova, Nexible, Coya, Element, Wefox via One Insurance, Flypper and NeoDigital). Of course, pursuing the license path is not mandatory to innovate in this market, but it demonstrates a certain level of involvement. However, the number of projects is not the most important. According to Crunchbase data, only 43 German startups in the insurtech category have been created in the last 10 years.

- As an important fintech hub, the United Kingdom is the most active country in Europe regarding the number of insurtechs created in the last decade with 110 companies. However, none of these is applying for an insurtech license at the moment.

- France is lagging behind with only 28 companies entering the previous criteria and only one of them officially got the license (Alan).

The Pro And The Cons of Obtaining a Licence Before Starting

Among the wannabe global insurtechs, some of them start as an insurer while other ones start with the broker status. The second often complains that VCs do not understand their viewpoint, here are their arguments:

- Agility: As an insurer, you have a lot of compliance requirements that you don’t have as a broker. By being an insurer too early, you can lose a lot of time in the process.

- Trust: Trust is critical in insurance, thus building a trustworthy brand by associating your name with a large insurance company before carrying your risk is an opportunity. It helps you to convince a lot of customers with a lower acquisition cost as customers trust well-known brands.

- Capital requirement: As an independent insurer you can design your offers as you want. It requires the right skills and the right data but you can do experimentations. However, the insurance industry is a bit more complicated. As an insurer, you don’t carry the whole risk by yourself, instead, you rely on re-insurers who have their word to say according to the level of risk they carry. So if you want to be hands-free, you need to raise a massive amount of funds in order to carry a substantial part of the risk by yourself (depending on the insurance category).

In addition, insurance partners are being more and more efficient and agile to work with startups. We have met several insurtechs that are very happy with their partner relationships. - Regulation: The law is not well designed for insurtech. As a broker you are very flexible with your use of cash. After getting the licence, your growth would require far more capital since you will need to have even more money set aside in your balance sheet.

- Use of data: As a broker, you can collect data to propose very different offers in the future. As an insurer, you are restricted in the amount of data you can collect. Having a transition period is good in some specific cases.

Who Are The Elephants in The Room?

Insurance has two sweat pots to challenge: Data and acquisition. The players who are naturally really performant in these areas could become natural competitors for future insurtech startups.

Thus, the competition from the GAFA is a recurrent threat for incumbents. Their knowledge about how to exploit large amount of data is a real asset in an industry where risk management is key. The GAFAs have never been closer to insurtech. Google has shown interest in its investment in Lemonade through Google Venture. Amazon made a move in 2016 by launching its first product in the area with Amazon Protect, a complementary guarantee. Amazon has taken part in the $12m round of the Indian insurtech Gecko. According to Reuters, Amazon could also launch an insurance comparison website in the UK. At the beginning of the year, Amazon also announced a partnership with Berkshire Attaway and JP Morgan on employee Healthcare. Even if the outcomes of the partnership are not clear at this stage, it embodies the clear desire of Amazon to enter the game.

User acquisition is also key of the industry since acquisition costs often exceed $100. Amazon combines not only a culture of data but also a tremendous distribution power. The Neobanks will also have their word to say in the area. Synergies between insurances and banks are obvious and Revolut, N26 and Monzo could finally be the next big insurtechs. The ambitions of the three European start-ups are clear. They have already put a foot in the area since when you install the app on a new phone, Revolut proposes you to insure it with a weekly payment. On its side, N26 offers international health insurance and travel insurance on its premium version. Their next move could be of a very different magnitude.

We Have a Few Strong Convictions On Insurtech:

After reviewing different projects, at daphni we tried to summarise the convictions we have as investors:

- We think that the differentiation of offering only a better price is not enough. The first clients you attract this way won’t be loyal nor valuable.

- As the number of touch points between an insurer and a client is really reduced, we also believe that UX and UI are important, but not enough to make a better value proposition.

- Transparency is key. Insurance policies are often very tricky and the level of trust of the user in their insurer is not high. As a consequence, we think that exemplarity will be key. The move of Lemonade to simplify the terms of service is a great example.

- Fast development in different verticals is of critical importance. As we have seen, the cost of acquisition (CAC) in insurance is really high. Proposing different products to a client you have reached is the best way to amortise this CAC. And according to Bain, it is also one of the main drivers of loyalty. We don’t think it is necessary to launch with different verticals, but we do think that it should be included in the short-term roadmap.

- Niche insurance products, such as for pets or drones, could have great margins but you need to mass sell them in order to have good margins. However, they constitute a really good acquisition strategy.

- Distribution is key as the CAC is tremendous for a B2C industry.

Thank you very much to @Willy Braun @Pierre-Yves Meerschman and @Cecilia Lundborg for their help. If you have interesting projects, or if you just want to chat about the topic feel free to reach at: stanislas@daphni.com