Proptech truly changes your life (1/2)

Proptech — property technology— revolutionises the real estate industry by focusing on its digitalisation and automation. Proptech is driven by the emergence of new digital and technology-focused start-ups offering the best solutions for the real estate industry. It uses indeed innovative technologies already successfully implemented in finance and economy today.

Its purpose is to reduce intermediaries as much as possible by using technology to simplify and modernise this dusty industry!

Construction in Proptech

In France, over 400 proptech startups have been created in the last 3 years and almost 500 millions euros have been invested in french proptech startups in 2019 according to Les Echos. On a global scale, investment in proptech industry could represent 20 billions by the end of 2020 according to KPMG. In this study, we are going to focus especially on the construction and property as a service sectors in the real estate market.

If we focus on the French market: proptech industry is an important part of the French economy, contributing to roughly 16.5% of the French GDP according to the OECD. Moreover, proptech is divided between construction which represents 18% of the startups on the proptech market, services (marketing and use) which constitutes 73% of the startups and finally 9% for financing startups.

✓ Construction industry

1/ Market size: Construction market could reach 15 800 billions in the world by 2030.

2/ Construction market allocation: China will be the main contributor followed by the USA and India.

3/ What are the main challenges in this market (according to Xerfi)

- Productivity: The constructors are trying to reduce building time (delivery delays are around 20%)

- User experience: Trend to adapt to consumers and improve the quality of services

- Security: Companies are looking to reinforce security on the building sites in order to limit the number of accidents and reduce mistakes (around 90 000 incidents in France each year)

- Sustainable development: demand is growing and legislation is binding (The Energy transition for Green Growth Act, 2015)

- Smart City : Build the city of tomorrow

4/ Key success factors for startups (according to Xerfi)

- Political: Demand is supported by publics authorities (applicants for infrastructure and thanks to grants that encourage construction)

- Economy: Raw material price volatility is high

- Society: Emerging countries are facing significant population growth leading to rapid urbanization which supports demand for housing

- Technology: New emerging digital tools facilitate the management of construction projects

- Ecology: Growing demand for “green” construction, but concerns persist about the environmental issues related to energy-intensive construction activities

- Legislation: Green construction is promoted through tax breaks, however, the constraints related to the safety of workers are tightening.

5/ Risks associated with construction projects

- Design default

- Budget underestimation

- Poor appreciation of the local environment

- Inappropriate contractualization

- Failure of a customer, partner or subcontractor

- Deadline failure

✓ Modular Building

1/ Market

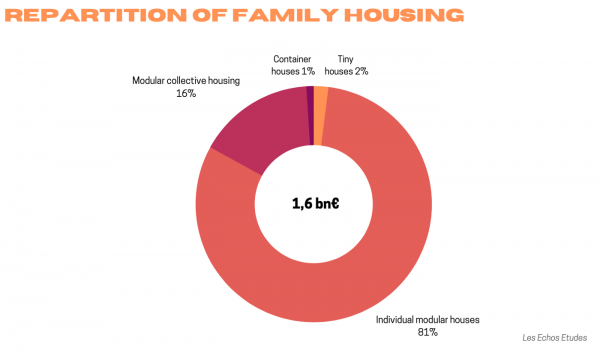

Modular building market which mainly involves wooden constructions represents 1.6 billion euros in France according to Les Echos and should reach 3 billions in 2030. This would represent 25% of new housing construction compared to 11% today.

Today, modular building market is made up of around 2000 SMEs, most of which are family businesses and therefore only locally based. In addition, they are often highly specialized in a particular sector of modular construction.

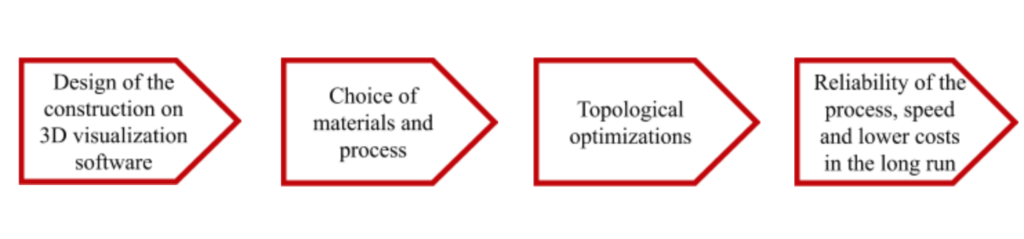

The process of modular wood construction is very similar to the one of the automotive industry. Firstly, the customer chooses the design of the construction as well as the possible options according to the catalogue offered by the modular house builder. Then the BIM allows to model the project. The construction elements are then prefabricated before being transported to the place where they will be assembled. Once the assembly is completed, the interior work (painting, sanitary, electricity) is carried out. The modules are then almost finished (90%) and are brought to the final site to be assembled using cranes. The business model is therefore similar to the business model of the automotive industry. The resulting cost management must therefore be similar to the one of the automotive industry.

Modular housing is also subject to town planning requirements (building permits, etc.). It is therefore a plus when the manufacturers take care of these procedures.

2/ Advantages

- Ecological

- Time saver

- Attractive pricing

- Customized offer

- Lower human resource requirements with less training

- Reduction of nuisance on construction sites

3/ External key factors

- Technology: Modular construction is facilitated by new technologies such as BIM, virtual reality… and its commercialization is promoted by Proptech platforms.

- Urbanism: In the context of global urban densification, modular housing makes it possible to create new living areas within an existing building.

- Sociology: Meets the need for a living environment closer to nature, with a need for modularity

4/ Actors

- PlantPrefab (2015, Serie A (investor : Amazon), fund raising of 9,7M $, sustainable and environment-friendly buildings )

- Sidewalk Labs (2014, Google project (investment of 50M), high-tech off-site wood construction)

- Katerra, created in 2015 (Unicorn) is already a dominant player in the construction industry. It allows to follow the construction from A to Z by realizing plans in BIM then it allows the prefabrication of many parts through the use of robots.

- 2 main actors: Cougnaud (Revenue of more than 165 millions) and GSCM (Revenue : 70 millions)

- Big companies already present such as Bouygues or Eiffage, which offers wood-frame buildings or container houses.

- Many small companies : GreenKub (2013, fundraising : 400K), Ossabois (Revenue : 40 millions), Woodyloft, ID maison bois, Citeden, booa, casasnatura, Cubik-Home (eco-innovative modular housing made of high-performance concrete), Corner.

Vesta construction: A company that builds healthy and sustainable buildings and improves working and safety conditions through off-site construction and the use of bio-based wood and materials.

5/ Challenges

- Reaching critical size: the price decrease will be possible when the company will grow. For the time being, because of the small size of the companies, there are very few economies of scale and the prices breakdown to the square meters are thus not necessarily less expensive than a traditional house.

- Ability of the transporters of exceptional convoys to follow the development of modular housing.

Interesting Startup: Sofrinnov — Modular construction from recycled wooden pallets.

6/ Perspectives

The modular construction market is already a market that has been growing for several years and has therefore already reached a certain maturity. It is therefore unlikely that startups will emerge and develop rapidly as they will have to compete with the larger players already present in the sector. Nevertheless, startups such as Sofrinnov, which combines modular construction with the ecological dimension of recycling materials, have, in my opinion, a chance to differentiate themselves and succeed.

✓ Smart materials, green materials:

1/ Market

Smart materials and green materials building market is expected to grow from 60.7 billion to 105.8 billion in 2024.

2/ The challenge

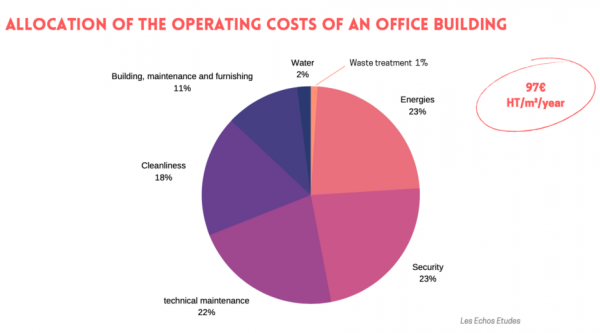

It is notably to reduce the energy consumption of buildings and more generally to reduce all costs of resources. In Europe, construction accounts for 31% of the use of natural resources and contributes 33% of waste (construction and demolition).

In addition, apart from the significant operating costs of buildings, regulations encourage the development of this market. Indeed, energy performance targets for buildings in Europe are high and a reduction in energy consumption in new buildings is therefore required.

3/ Key success factors for emerging startups

- Strong customer demand

- Environmental regulations

- Ambition to build a world that respects the environment

4/ Barriers

- Purchase price are often high

5/ Actors

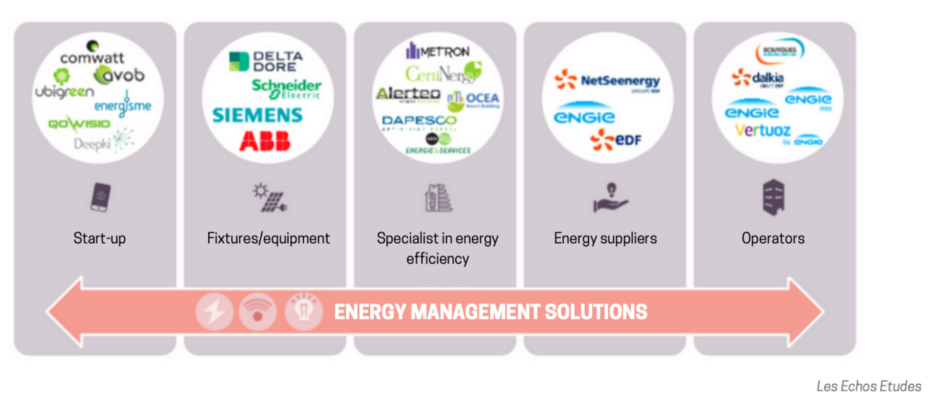

Smart materials: Energy management is a sector in which there are already many players from a variety of backgrounds and competition is therefore particularly fierce.

Similarly, regarding the development of glass panes allowing the use of daylight, many technologies have been developed and several companies are therefore present in this sector. View (Unicorn, sageglass (https://www.saint-gobain.com/fr/sageglassr), Research frontiers (Smart Glass), Pleotint (serieA, USA, dynamic glass technology), Physee (photovoltaic glass that transforms a window into a solar panel, a similar solution was proposed by Tesla).

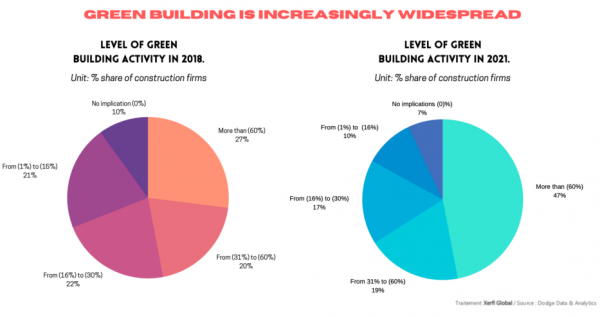

Green materials: There’s a different set of technologies emerging. In addition, the market is in demand as green building is becoming more and more important.

The number of environmentally responsible construction projects is constantly increasing.

There are various green building materials available :

- The wooden structure: Wooden frame used as a structure in the construction of a house

- The single-wall terracotta brick: It is a clay brick which has insulating properties and therefore does not require the addition of an insulator.

- Aerated concrete: It is a mixture of sand, cement, lime with a little aluminium powder and air. It is a good thermal insulator and is appreciated for its lightness.

The trend is towards wooden construction and construction with “ecological” concrete.

Labels already exist to certify green buildings and buildings with these accreditations have a higher real estate value.There are also several startups offering platforms for the circular economy such as Cycle up, Hesus, Backacia (French startup, reuse of building materials)

There are currently a limited number of players making green materials. Moreover, these actors often have innovative technology at their disposal, constituting a barrier to entry for potential entrants. Nevertheless, more and more large groups and traditional suppliers of building materials are developing similar green materials.

Interesting Startups :

- Backacia: France, 2016 — marketplace of building materials from deconstruction or surplus

- Woodoo: France, 2016, last fund raising of 3,2M et (5,2M in global) — high-tech wood

- Neolithe: France — transforms waste into building materials

- Materr’up: France — low carbon concrete production

- Syscobat: France, 2016 — B2R+ system combining concrete and wood with bio-based materials.

6/ Perspectives

The market for smart materials and green materials is an emerging market that will experience rapid growth in the coming years. The startups that are currently emerging will therefore be able to play their part and establish themselves as the main players of tomorrow. Competition is likely to be tough, however, as the major materials producers are also trying to follow the ecological trend and are therefore increasingly looking to offer intelligent or green materials.

✓ Self-sufficient houses

1/ Market benefits

- Strong demand

- Subsidies (green buildings)

However, consumers are often reluctant to build a self-contained home because they think that they will lack information and support, that prices will be very high, or that it will compromise their lifestyle.

2/ Challenges

- Obtaining legislation, official certifications of self-sufficient houses

- Reduce costs and delivery times for procurement of green materials, improve the supply chain

The market for self-sufficient houses is becoming increasingly important because, in addition to the emerging environmental awareness, self-sufficient homes also allow for savings on energy and water bills. The market for self-sufficient homes is an emerging market that should significantly grow in the coming years if the players manage to keep up with demand.

3/ Actors

🇺🇸 USA: OBI (help to build self-sufficient house)

🇪🇺 Europe: Zedfactory (UK), PassivDom (Ukraine, self-sufficient houses printed in 3D in 8h)

🇫🇷 France: France has fallen behind the other global players, but there are still self-sufficient home builders : Majamaja (Franco-Finnish, develops autonomous houses), Atome, Projet Comepos, Be&Co, Néoabita, Soleta, Czech sustainable houses

🇮🇱 Israel: The Sustainable Group (2017, project Village in a box, self-sufficient houses

Tav Group (at the origin of several projects of self-sufficient houses, Ein Hod ecological house, marijuana house)

4/ Perspectives

There are currently no dominant players in the self-sufficient housing market, as most companies are in the project phase and therefore do not yet sell their homes at a large scale. However, an increasing number of companies are offering either a service to accompany the construction of a self-sufficient house or directly to build a self-sufficient house. As far as the offer for the construction of autonomous houses is concerned, its development is limited by technological entry barriers and some companies will therefore be able to establish themselves as dominant in this sector in the coming years.

5/ Interesting startups

- Solaire Box (wooden construction with a photovoltaic roof, created in 2014, France, fund raising of 1,5M)

- Birkawood (2016, construction of passive houses with wooden bricks)

- Majamaja (2017, Franco-Finnish, self-contained house installed in less than 24 hours)

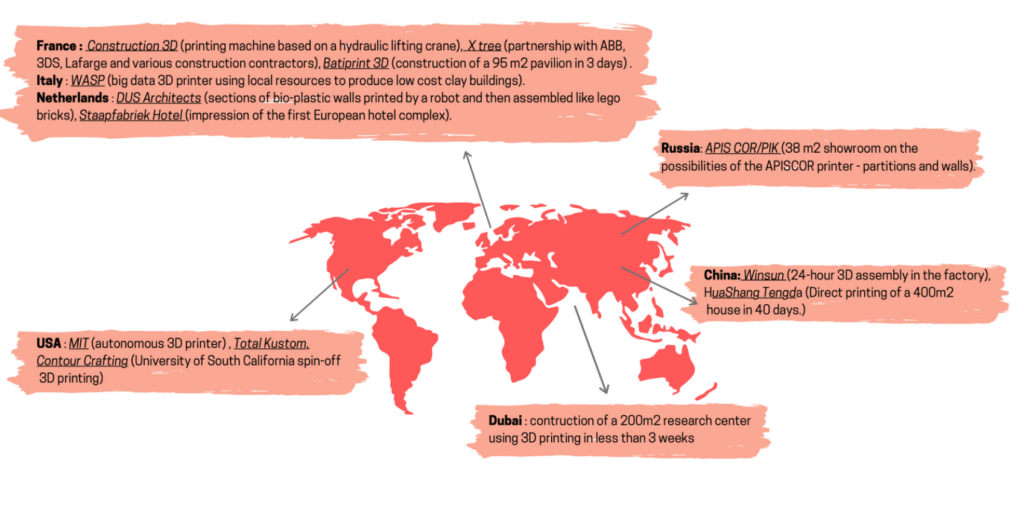

✓ 3D Construction

1/ Market

The 3D construction market is growing and is expected to grow from $3 million in 2019 to $1575 million by 2024 according to marketsandmarkets.

The 3D printer is developing for both modeling and construction itself. Indeed, it makes it much easier and faster to produce models. The model plays the role of a communication tool regarding the customers.

From a construction point of view, 3D printing is developing because it enables houses to be built directly on site in very short times and to reduce geometric constraints from an architectural point of view.

2/ Advantages

- Reduction of construction time (Winsun has built houses in 24 hours)

- Enhanced reliability

- Greater freedom in design and often easier assembly with fewer parts (few geometrical constraints).

- Reduction of the product mass without altering its rigidity because of topological optimization of the machine and therefore reduction of the material used.

- Reduces the risk of accidents on the construction site

- Reduces the drudgery of work

- Making possible more environmentally friendly construction — reduces CO2 emissions (less waste, less transport…), allows Bio mimicry (ex: regenerating habitats)

- Little storage logistics are required because materials can be used directly by the 3D printing machine (does not have to cope with the weather).

- Reduced labour requirement

3/ Drawbacks

- Relatively expensive machine

- If the geometry is complex, the design often has to be done with temporary holders that will be removed as the printing is completed, thus incurring additional costs.

- Few economies of scale

4/ Actors

Since the 1990’s, the emergence of players in the field of 3D construction printing, often coming from research laboratories. (Contour Crafting, University of California).

France and Europe are important players on the 3D printing market and several European companies are already surrounded by renowned partners. Nevertheless, most European companies remain small and are in the process of developing.

Europe: D-shape (Italy), WASP (Italy), COBOD (Danemark), MX3D (Netherlands), DUS architects (Netherlands), 3D printhuset, CyBe, Be More 3D.

France: XtreeE (Vinci), Construction 3D and BatiPrint 3D.

USA: Icon (fundraising of 9millions), Contour Crafting, Branch Technology, SQ4D.

China: HuaShang Tengda, Winsun

Russia: Apis Cor (6M€ fundraising), Specavia.

Players in the USA and China are also often new entrants, although some companies such as Winsun have been on the market for more than a decade.

All of these companies offer similar house building services via 3D printer, however they do not use the same construction technology.

5/ Challenges

- Increase machine productivity

- Increase the ecological dimension (energy reduction, use of recyclable materials, recycling)

- Intellectual property of processes (Certifications, counterfeiting of spare parts, reproduction of the same product from the digital file…)

- Technological advances to be able to build all types of buildings

6/ Perspectives

3D printing is a growing market and the prospects in terms of construction are immense. It facilitates the modeling and allows to realize constructions more quickly. In addition, processes will improve. Construction times will be reduced until houses are produced in 24 hours and costs will be reduced because the proportion of labor used will be much lower.

Finally, this technique allows to respect the ecological stakes because it reduces the quantity of raw materials used and will surely be able to use recyclable materials in the near future. The construction market is a very important market and 3D printing only represents a small stake and is therefore set to grow.

However, it could be confronted to a new wave of innovation: 4D printing. This corresponds to 3D printing to which the dimension of time is added. In other words, the printer assembles materials that are equipped with an AI and are programmed to change shape over time according to the environment or temperature. (A building that would change according to weather conditions, for example). However, this 4D technology remains at the research stage for the time being, and given the extensive knowledge and research on materials it requires, it seems unlikely that it will be applicable on a large scale in the near future.

7/ Interesting others startups

- Batiprint 3D: France, 2017 — construction 3D

- Construction 3D: 3D house printing

✓ Construction Monitoring technology

Apart from BIM, there are other construction monitoring solutions such as:

BuldozAir (French equivalent of the American PlanGrid) which is a SaaS solution for monitoring and collaborative management of construction sites in real time and in mobility.

It is a competitor of BIM and is thinking of eventually using BIM as well. So in this sector it is BIM technology that wins the day and BIM is already very present on the market.

Conclusion

In France and around the world, overall competition is fairly balanced. Thus, we are seeing the emergence of real leaders in each sector. On the other hand, the newest startups are often positioned in niche markets and have high technological added value and are therefore not threatened in the short term.

Most French companies are expanding to the global market and will therefore most certainly be able to take advantage of the growth in real estate, particularly in Asia and Africa. Moreover, the risk of oversupply by companies, which would unbalance supply and demand, is low because the technological barriers to entry are high. Finally, it remains to be seen whether a Katerra-type company (a model where everything is integrated) will become widespread, as this could threaten start-ups that focus only on one aspect of construction. However, the investment required to achieve an all-integrated model is huge, which limits the risk.

Concerning the different markets we have focused on, the modular construction market seems to be well advanced in its development and the investment opportunity is therefore limited. In addition, the green materials market and 3D construction are two markets that are in full development and therefore where it is very likely that some startups will manage to make a difference. Finally, the market of the autonomous house is a market with great potential but is still a relatively young market.

Do not miss the part 2 available here.

With Love,

The Daphni Team❤️

A HUGE thanks to Olivia Gangneux & Alma Rathle for their work on this report!

China:

China:  Russia:

Russia: