Do entrepreneurs need to be risk-takers?

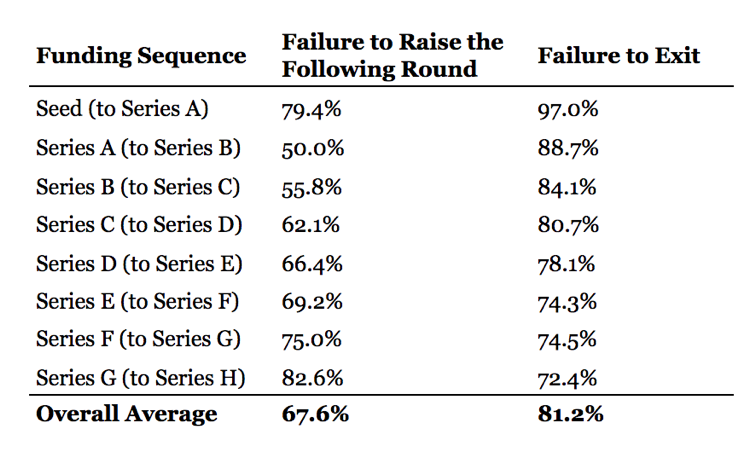

In France, Venture capital is called Capital risque. Indeed 90% of ventures will fail and 50% of the ventures that have raised a series A die within 5 years. Therefore, it is a risk to start its ventures knowing that a new entrepreneur has only 10% chance of success. As J.F. Kennedy said “Victory has a thousand fathers, but defeat is an orphan” which means that a single cause can lead to failure whereas the success is the combination of small successes.

First of all, a risk can be defined by two variables: the chance of success and what there is to lose. These two variables will set the level of how much an entrepreneur is risk-taker. If the entrepreneur launches his venture during his studies or just after and his project is not cash consuming and has a high chance of success because it has vocation to stay little and can work with few clients, then this entrepreneur will have taken a risk that is far less than if he had launched his project by quitting his previous job, if he had a family to feed, a mortgage to pay and if his project was highly ambitious but required 2 years of heavy R&D with a low chance of success. For (Keh & al., 2002) the risk appreciation depends on four independent variables (overconfidence, belief in the law of small numbers, planning fallacy and the illusion of control), a mediating variable (risk perception), two control variables (demographics and risk propensity).

Indeed, the most difficult part of an entrepreneurial journey is the start. Most of the time, entrepreneurs give up a secured situation with a monthly salary to start their own business that has 90% chance to fail. Revenue is not coming directly after the launch. Some entrepreneur will invest a big amount of their own money to start without paying themselves, sometimes for more than a year. For instance, in France it costs € 640 only to legally create a company.

The first round of financing is usually called the Friends, family and fools (FFF) funding. Because a company needs capital and the only people that are willing to take the risk of financing a company that has 90% chance of failure are only the relatives and the fools. Therefore, an entrepreneur put himself at risk but also his loved ones.

The risk of failure is the global risk that pops in our mind when we speak about entrepreneurial risk. But there are several types of risk regarding money, decision process, vision, market, lifestyle, human resources…

Financial risk: Most of the time, entrepreneurs leave a salary and invest money in their project without any certainty of earning money from it.

Risky decision: Every decision that an entrepreneur takes has a direct impact on his project. A single bad decision can be deadly for the venture. These decisions are business decision on the vision, the go to market, the product, the market fit (…) and have to be taken by the entrepreneur even if it is not his skills area.

Human risk: Behind a success there is always a team. This team is built directly by the entrepreneur. One bad hiring can jeopardize the entire project. More than that, a good entrepreneur has to incentive his team by giving them capital of the company which is a risk to see part of the capital going away with employees leaving the company.

Lifestyle: More than the only financial part, the entrepreneur risks his lifestyle. An entrepreneur needs to work harder than a lambda employee. Therefore, he will have less time to enjoy his family, do his hobbies and spend the money he doesn’t have.

At every step of a venture, there are important personal and professional decisions that have to be taken. If the entrepreneurs choose a wrong path it risks losing everything he has invested to build his own business (time, money, reputation, a good situation…). But Palich and Bagby (1995) suggested that entrepreneurs see opportunities where others see risks. For them, it is not risks to take but opportunities to catch. It is by catching those opportunities that an entrepreneur will succeed. Then, once the entrepreneur has launched his business, he sees risks as a normal path to success.

Entrepreneurs deal with uncertainty on a daily basis. Will this client sign the contract? Will my advertising reach the good population? Is my product good enough? And so on so forth. But uncertainty is risk (Keh et al., 2002) and can be a reason of success as much as a reason of failure. It is by taking risks and betting on uncertain events that an entrepreneur grows his business. The key of success is innovation. An entrepreneur needs to offer something new in order to win new customers. But you cannot be sure of the adoption of your innovative product/service.

An entrepreneur is not becoming risk-taker while creating his business. It is his past experience that gave him an entrepreneurial mindset. The disposition to trust would affect future entrepreneurs’ perceptions of risk and thereby their confidence in the outcomes of their entrepreneurial opportunities (Colquitt et al., 2007; Welter, 2012). Trust can be cultivated at the pre-entrepreneurial stage so that future entrepreneurs are appropriately equipped and geared to cope with risk in entrepreneurship activities. (Zeffane, R., 2015). Therefore, an entrepreneur that already had one success is more likely to create a new venture because he is confident, has learnt from his previous experience and his risk perception is better.

Finally, to be in the 10% successful ones, an entrepreneur needs to think big, to have ambition, to be confident and to imagine new solutions. These characteristics require to take risks. Whether it is small risks that can be measured and control or bigger ones that can jeopardize the venture a good entrepreneur needs to take it.

Bibliography

Stewart Jr, W.H. and Roth, P.L., 2001. Risk propensity differences between entrepreneurs and managers: a meta-analytic review. Journal of applied psychology, 86(1), p.145.

Keh, H.T., Foo, M.D. and Lim, B.C., 2002. Opportunity evaluation under risky conditions: The cognitive processes of entrepreneurs. Entrepreneurship theory and practice, 27(2), pp.125–148.

Colquitt, J.A., Scott, B.A. and LePine, J.A., 2007. Trust, trustworthiness, and trust propensity: a meta-analytic test of their unique relationships with risk taking and job performance.

Welter, F., 2012. All you need is trust? A critical review of the trust and entrepreneurship literature. International Small Business Journal, 30(3), pp.193–21

Palich, L.E. and Bagby, D.R., 1995. Using cognitive theory to explain entrepreneurial risk-taking: Challenging conventional wisdom. Journal of business venturing, 10(6), pp.425–438.

Simon, M., Houghton, S.M. and Aquino, K., 2000. Cognitive biases, risk perception, and venture formation: How individuals decide to start companies. Journal of business venturing, 15(2), pp.113–134.

Thorpe, R., Gold, J., Holt, R. and Clarke, J., 2006. Immaturity: the constraining of entrepreneurship. International Small Business Journal, 24(3), pp.232–250.

Zeffane, R., 2015. Trust, personality, risk taking and entrepreneurship: Exploring gender differences among nascent and actual entrepreneurs in the United Arab Emirates. World Journal of Entrepreneurship, Management and Sustainable Development, 11(3), pp.191–209.

Thanks to Aurélie van Peteghem.